Filling an investment gap of trillions is critical to realizing energy transition, climate, and development objectives, and 2023 should be a year of unprecedented focus on increasing investment in these areas in emerging and developing economies (EMDEs).

A recent landmark report estimates annual climate investments in EMDEs other than China must reach $2.4 trillion by 2030 — a four-fold increase. Of this, $1.5 trillion will need to be dedicated to transforming the energy system, and around $1 trillion would be international flows from private investors, multilateral development banks, and others, all against a challenging international backdrop of multiple crises and geopolitical tensions leading to widespread stagnation in investment levels.

Mobilizing private finance is vital and is expected to provide around 70% of the financing for capital-intensive clean energy technologies and low-carbon solutions. Past efforts to enhance the mobilization of private investment and finance, including those by multilateral development banks (MDBs) and other public finance institutions, have had limited success.

At the same time, private investors often point to barriers to energy transition investments in many EMDEs related to sector policy and regulatory factors such as permitting for clean energy projects, connections to the grid, fossil fuel subsidies, and uncertainty about off-takers’ ability to honor contracts. Barriers and risks in the energy-related sectors, the financial sector, and the broader economy delay the energy transition by limiting the supply of investable projects and increasing the cost of financing.

It will take a systems approach to get to “the trillions”

Effective investment and finance mobilization must integrate climate and development objectives and country, sector, and international dimensions. New Climate Economy, OECD, and others have repeatedly brought forward this message.

Development and energy transition priorities must integrate to create an attractive investment climate and robust pipelines of energy transition investment opportunities. This integration requires deploying a range of coordinated measures such as a 1.5° C-aligned energy transition pathway, energy system investment planning, enabling clean energy policy and market regulation, and targeted risk-sharing instruments. Altogether these measures have the potential to turn energy transition investment needs into pipelines of investment opportunities.

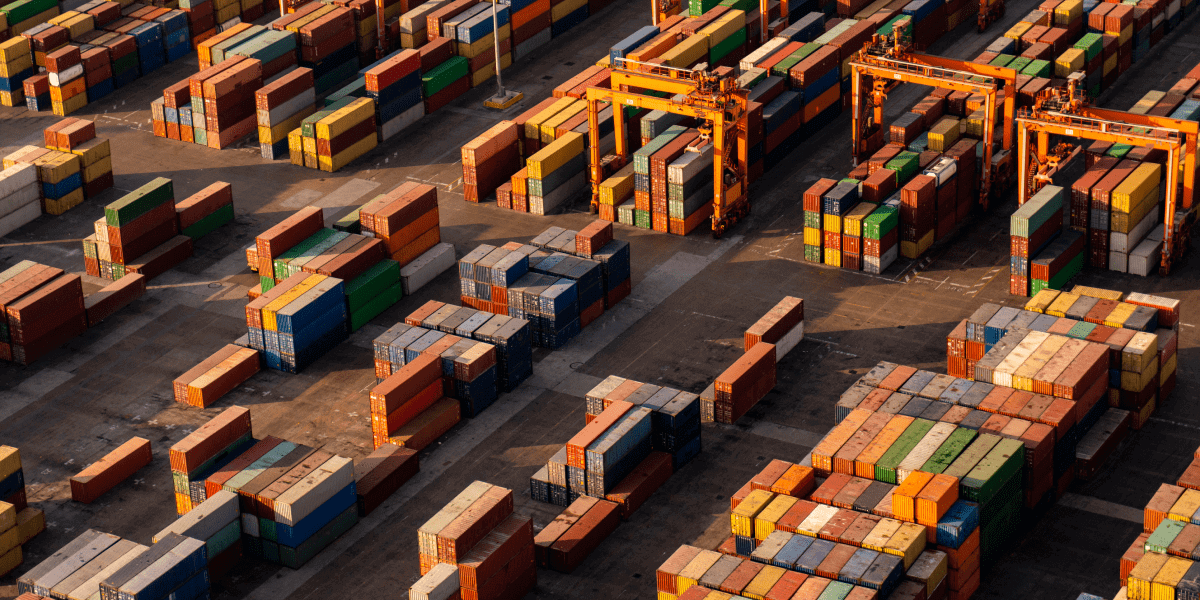

At the national level, a whole-of-economy and whole-of-government approach covers all of the real economy sectors that are part of the energy system (i.e., energy supply, industry, buildings, and transport), the financial sector, as well as macroeconomic and crosscutting dimensions, such as trade, industrial policy, and taxation.

The international ecosystem also plays an essential role in mobilizing investments and finance. However, current international support for country energy transitions tends to be a patchwork of bi- and multilateral efforts operating in silos, which, together with limitations in the international toolbox of catalytic instruments, reduces the effectiveness of international cooperation and support.

A practical framework for catalytic action will require international actors to align and support government-led country transitions. An integrated approach must address interactions between the international and country systems in the real economy and financial sectors, along with barriers at the international level and within the countries supplying clean energy technologies and finance.

Catalytic action for systemic impact

Focused efforts in five priority areas can prepare the international ecosystem for catalyzing investment in country and sector transitions:

1. A commitment to catalyze

MDBs and other public financial institutions must reorient their operating models toward an emphasis on mobilizing “the trillions” — particularly when it comes to investment in energy-related sectors and in middle-income countries where mitigation efforts are most urgent. A tangible approach would be a commitment to catalyze that could include a range of direct and indirect functions to support mobilizing investments and finance. Commitments should be impact-oriented and specific enough to drive adjustments to the operating models of the MDBs. KPIs should also incentivize MDBs to take responsibility for the effective functioning of the international ecosystem of support for country energy transitions and investment mobilization.

Other public financial institutions such as bilateral development finance institutions, national development banks, and central banks also play catalytic roles and should consider taking similar steps. The IMF is also expanding its role within the international ecosystem, raising additional capital by channeling Special Drawing Rights and developing new ways to support climate action. Beyond public financial institutions, other international institutions must consider how they can do more to make their specific expertise and resources available in support of catalytic efforts.

2. Risk mitigation instruments

There is widespread recognition of the need to address real and perceived risks associated with private sector investment and finance in energy transitions. Frequently highlighted risks include macro risks, such as exchange rate risks, regulatory risks related to permitting, and credit risks, such as off-taker risks for clean energy supply. Because unmitigated risks limit the supply of investment opportunities and increase the cost of capital, there is a need to develop and capitalize specific instruments that offer standardized risk mitigation instruments available to public and private actors at scale and with low transaction costs.

3. Vehicles and platforms to channel institutional capital

Various vehicles and channels are part of the “plumbing” that allows international finance to flow to real economy investments in EMDEs. Solutions exist inside and outside capital markets, channeling equity and debt, such as green bonds, for climate-related investments. Blended finance can improve risk/return profiles of investments, but there is a need for further work on the design and deployment at scale.

4. Country and sector platforms

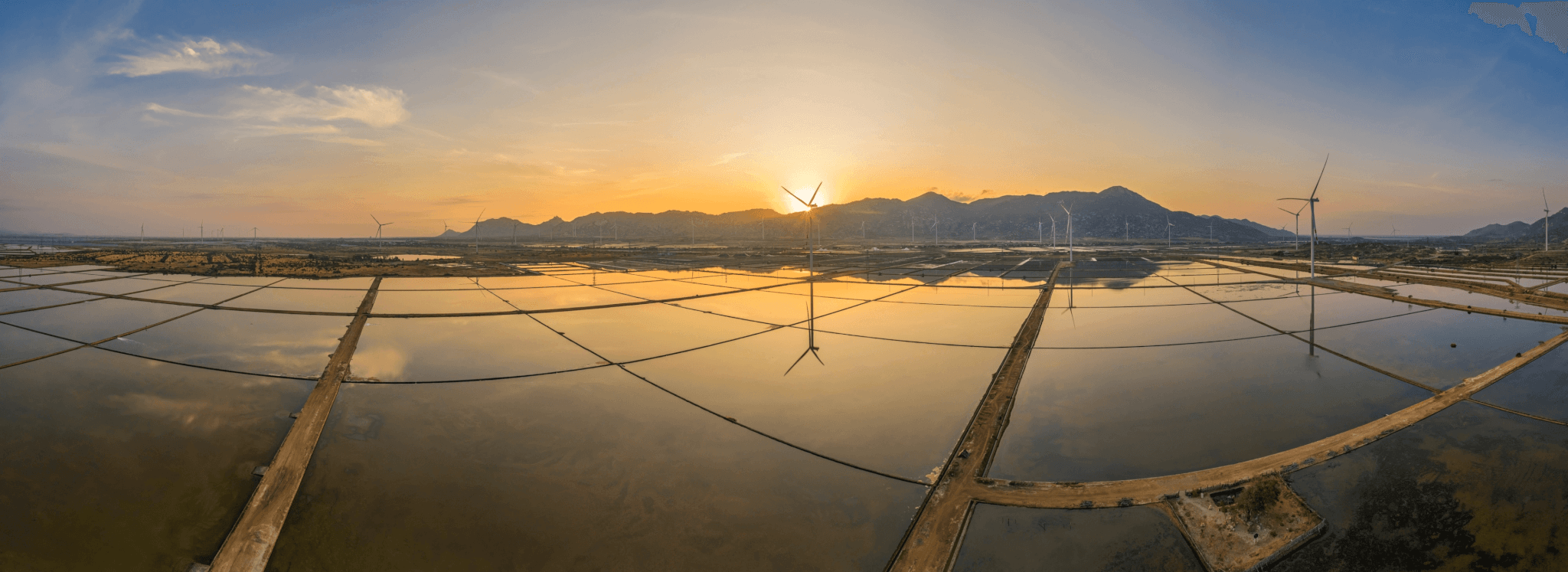

There is increasing interest in comprehensive approaches to cooperation around accelerated country transitions. The Just Energy Transition Partnerships in countries like Indonesia, Vietnam, and South Africa are becoming test cases for efforts to mobilize and align international donors and private investments to accelerate developing economies’ energy transition.

Country and sector platforms may connect national and international ecosystems and help align public and private, real economy, and financial actors around cooperation to mobilize investments and finance at scale for the transition. While there are no off-the-shelf playbooks for structuring platforms and transition partnerships, there is enormous potential for more streamlined international cooperation from further developing and deploying such models.

5. Addressing supply-side barriers

Faced with the challenge of scaling up investments both at home and abroad, wealthy countries need to ensure a corresponding increase in savings and address any “home-grown” impediments to channeling part of these savings into investments in EMDEs. Supply-side barriers may be related to regulations and practices within the countries supplying the investments or to international regulations and agreements.

Making it happen: Taking advantage of opportunities in 2023 to step up action

Improving the international architecture around investment and finance for the energy transition, climate, and development is high on the agenda in 2023 and beyond. This week’s Summit on a New Global Financing Pact offers a high-level moment for new approaches to catalyzing investments and finance, the G20 and the UNFCCC have called upon MDBs to adjust their operating models and scale up mobilization of climate finance, and the UAE COP28 Presidency has made investment and finance a priority theme.

Many efforts to develop actionable solutions are ongoing, creating several opportunities for governments, philanthropy, and the private sector to step up their contributions. In doing so, they should consider two areas in which scaled-up catalytic funding is essential.

- Investing in human and institutional capacity to make the economy function more efficiently, generate pipelines of investable opportunities, and connect them with domestic and international finance. These “soft investments” are often underappreciated and underfunded.

- Using seed funding and capital injections for risk mitigation and blended finance instruments. These will require significant nominal capital commitments, although the actual cost (e.g., reflecting realized losses on a guarantee instrument) will typically be much smaller.

Sustainable development and climate objectives require massive investments in the energy transition. Realizing this will require governments, the private sector, and institutional actors to rally behind ambitious investment strategies. Moreover, actions will be most impactful if they build on a shared effort to make the international ecosystem more effective in catalyzing investment and finance.